Free Mobikwik Xtra VS BharatPe 12% Club: Which Offers Better Returns and Security? Mobikwik Xtra VS BharatPe 12% Club: Unveiling the Best P2P Lending Platform for You. Choosing the right P2P lending platform can be a daunting task, especially when you’re faced with multiple promising options. Mobikwik Xtra and BharatPe 12% Club are two such platforms, attracting a growing number of users due to their unique features and benefits. To simplify your decision-making, this article provides an in-depth comparison between the two platforms. Mobikwik Xtra VS BharatPe 12% Club: Unveiling the Best P2P.

Peer-to-peer (P2P) lending is disrupting the way people invest and borrow money. Two players that have emerged as giants in this space in India are Mobikwik Xtra and BharatPe 12% Club. While Mobikwik Xtra caters primarily to Mobikwik wallet users and operates via its underlying P2P platforms Lendenclub and Rupeecircle, BharatPe 12% Club also offers competitive investment and borrowing solutions. So, how do you decide which platform is right for you? Here, we bring you an in-depth comparison of Mobikwik Xtra and BharatPe 12% Club to help you make an informed decision. Mobikwik Xtra VS BharatPe 12% Club: Unveiling the Best P2P.

Also Read:

Choosing between Mobikwik Xtra and BharatPe 12% Club for P2P lending? Our comprehensive comparison dives into interest rates, security, user experience, and more to help you make an informed decision. Find out which platform aligns best with your financial goals! Mobikwik Xtra VS BharatPe 12% Club: Unveiling the Best P2P.

What Are Mobikwik Xtra and BharatPe 12% Club?

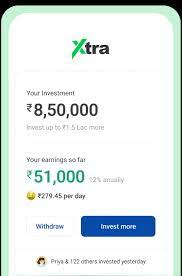

Mobikwik Xtra

Primarily serving Mobikwik wallet users, Mobikwik Xtra operates with Lendbox as its underlying Peer-to-Peer (P2P) lending platform. It focuses on providing hassle-free loans and allows users to earn better interest rates on their investments. Mobikwik Xtra VS BharatPe 12% Club: Unveiling the Best P2P.

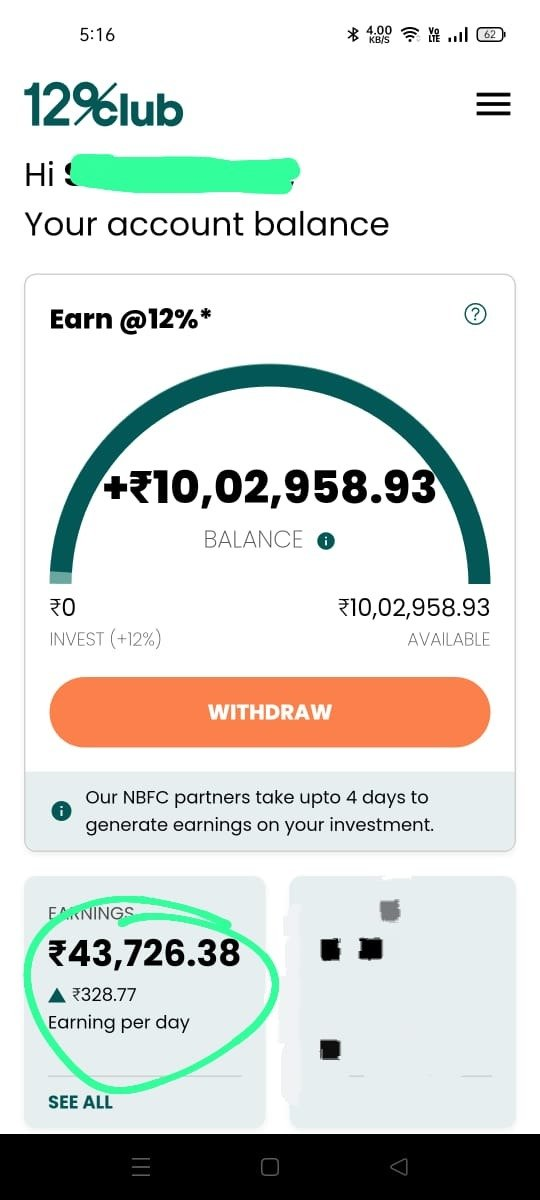

BharatPe 12% Club

The BharatPe 12% Club, on the other hand, associates with Lendenclub and Rupeecircle as its underlying P2P platforms. Designed to offer consistent returns, this platform also provides an array of financial services in addition to loans.

Mobikwik Xtra VS BharatPe 12% Club Key Comparison Points

Interest Rates

- Mobikwik Xtra: Offers competitive interest rates, generally higher than traditional savings accounts.

- BharatPe 12% Club: Promises an interest rate of up to 12%, which can be a big draw for investors.

Security Measures

- Mobikwik Xtra: Comes with the backing of Lendbox, providing multiple layers of security.

- BharatPe 12% Club: Utilizes security protocols from both Lendenclub and Rupeecircle, ensuring enhanced protection.

User Experience

- Mobikwik Xtra: Known for its easy-to-use interface, it caters mainly to Mobikwik wallet users.

- BharatPe 12% Club: Offers a more diversified experience but may require a learning curve due to the multiple services it offers.

Target Audience

- Mobikwik Xtra: Ideal for Mobikwik users who want to dabble in P2P lending.

- BharatPe 12% Club: Suitable for those who are looking for a range of financial services apart from just lending.

FAQs:

Can anyone join Mobikwik Xtra?

What is the expected ROI on BharatPe 12% Club?

Which platform is more secure?

Conclusion:

Both Mobikwik Xtra and BharatPe 12% Club have their own sets of advantages and disadvantages. While Mobikwik Xtra is a great fit for existing Mobikwik users and those new to P2P lending, BharatPe 12% Club offers a more diversified range of services and higher interest rates. Your choice should depend on your financial goals, the level of security you require, and the type of user experience you prefer. With the right platform, you can maximize your returns and minimize risks. Make an informed decision and invest wisely!

Disclaimer: Always make sure to read all the terms and conditions and understand the risks before investing in any financial products.

Leave a Reply