CRED vs CheQ: An Ultimate Comparison for the Best Credit Management App. If you’re looking for an app to manage your credit card bills, two popular options in India are Cred and CheQ. Both apps offer a convenient way to pay your credit card bills, track expenses, and earn rewards. But which app is the better choice for you? In this article, we’ll compare Cred vs CheQ and help you decide which one to use.

Difference Between CRED vs CheQ:

Looking for the best app to manage your credit card bills in India? Two popular options are Cred and CheQ. Both apps offer convenient payment options, expense tracking, and rewards programs. However, there are some key differences between the two. Cred offers Cred Coins for paying bills on time, while CheQ has a Smart Savings feature to help you save money. In terms of reliability, Cred has faced data privacy concerns in the past, while CheQ has not. Ultimately, the choice between Cred vs CheQ comes down to personal preference and which app suits your needs best.

Also you can Checkout:

- Download APK Cred Referral Code Earn Free ₹100 Amazon Gift Voucher

- Download APK CheQ Referral Code Get Free Rs 100

CRED vs CheQ: Sign-Up Process

Both Cred and CheQ have a simple sign-up process. To create an account on Cred, you need to provide your mobile number and verify it with an OTP. You can then add your credit cards to the app and start making payments. Similarly, on CheQ, you need to sign up with your mobile number, verify it with an OTP, and add your credit cards.

CRED vs CheQ: Features Comparison

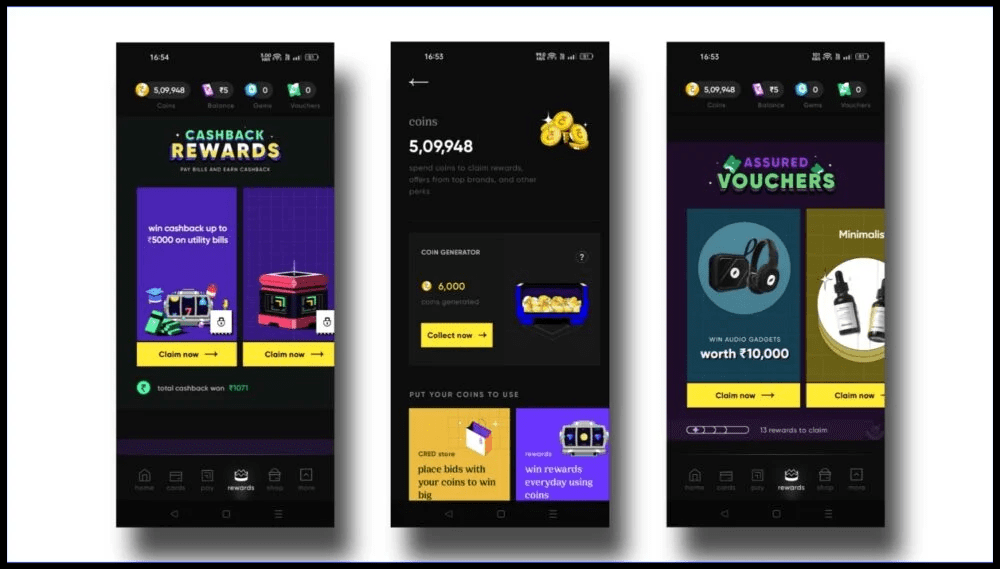

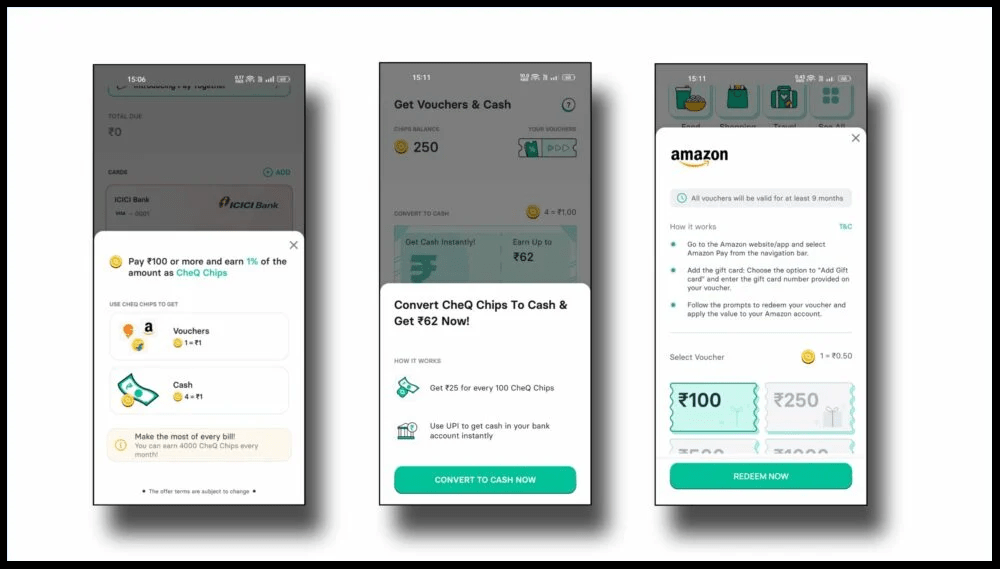

Cred and CheQ have similar features, such as the ability to pay credit card bills, track expenses, and get reminders for due dates. However, Cred also offers a feature called Cred Coins, where you earn coins for paying your bills on time, and can use them to redeem rewards like cashback and discounts. CheQ, on the other hand, offers a feature called Smart Savings, which helps you save money by suggesting the best credit card to use for specific purchases.

CRED vs CheQ: Rewards Comparison

As mentioned above, Cred offers rewards in the form of Cred Coins, which can be redeemed for cashback and discounts. The rewards are tiered, with higher rewards for users with a better credit score. CheQ, on the other hand, offers rewards in the form of cashback and discounts for using the app to pay your credit card bills. The rewards are usually lower than Cred’s, but there are no tiers based on credit score.

CRED vs CheQ: Which is more reliable?

Both Cred and CheQ are reliable apps that have been well-reviewed by users. However, Cred has faced some controversies in the past related to data privacy, which may be a concern for some users. CheQ, on the other hand, has not faced any such issues.

FAQs about CRED vs CheQ:

Is Cred or CheQ better for paying credit card bills?

Do both apps offer rewards?

Which app is more user-friendly?

Conclusion:

In conclusion, both Cred and CheQ are great apps for managing your credit card bills. They offer similar features and rewards, but Cred has an edge with its Cred Coins feature. However, if data privacy is a concern for you, CheQ may be a better option. Ultimately, it comes down to personal preference, and you can try both apps to see which one suits you best.

Leave a Reply